Filing your taxes on April 15? What if someone has already filed “your” income tax return? Sadly, this can happen, and it does happen, all too often. Here’s why, and what you can do about it.

In America today, tax identity fraud is a relatively easy and low risk means of turning law breaking into money making. So, on the eve of the April 15 deadline for filing Form 1040, the U.S. Individual Income Tax Return, it is important to consider what happens in the following nightmare scenario: someone other than you has already filed “your” income tax return.

If someone has used your identity to file a return in your name already, and you are filing electronically, your legitimate return will be rejected; if you file by mail and there is already a return on file, you will eventually get a letter from the IRS telling you about the situation, questioning your legitimate return. In both cases, any refund that is owed to you will be delayed.

Later in this article I discuss how to deal with these situations and hopefully prevent them, but first let’s look at the size and scope of the monster we’re dealing with here.

[Update 4/22/14: Our good friend Brian Krebs is reporting on a “Spike in Tax Fraud Against Doctors” and offers details of what appears to be a major tax ID fraud operation. Brian also reports on an organized crime gang’s tax scam targeting HR departments.]

The nature of tax identity fraud

To say that tax identity fraud is rampant in America would be an understatement. The perpetrators have used this scam to steal billions, and the number of innocent victims over the last three years is in the millions. The IRS published a dossier of tax identity fraud cases it has prosecuted, listing details of the fraud committed. It makes for pretty depressing reading, apart from the fact that all of these people were convicted. Sadly, convictions are not a strong enough deterrent for some people.

Consider case of Rashia Wilson of Tampa Bay, Florida, the self-proclaimed “Queen of IRS Tax Fraud.” She raked in millions by filing bogus returns (while convicted of stealing $3.1 million, estimates of the actual proceeds from her activities range from $7 to $20 million). And Ms. Wilson did this despite a lack of education—she never made it past sixth grade—and a lack of common sense, as demonstrated by her taunting of the authorities on her Facebook page. Yes, she bragged about her crimes on her actual Facebook page, with her real name and photos of herself waving huge wads of cash. Thanks to such lapses in judgment, Ms. Wilson is now serving a 21-year prison sentence, but she also serves as living proof that ripping off the IRS is way too easy.

Here are more staggering numbers from TIGTA, that’s the Treasury Inspector General for Tax Administration, which reported in 2012, “Potentially fraudulent tax refunds issued total approximately $3.6 billion in 2011, which is down by $1.6 billion compared to the $5.2 billion TIGTA reported for Tax Year 2010.”

So it’s no surprise that tax identity fraud is a growth industry, impacting a disturbing 1.2 million taxpayers in calendar year 2012, but a staggering 1.6 million in the first six months of 2013. Those numbers are direct from the TIGTA, whose tax identity fraud report of September, 2013 (.pdf), also documented the pain that taxpayers face if they fall victim to this crime. In a random sample of 100 cases reviewed, “case resolution averaged 312 days.” In other words, making things right can take 10 months, if you’re lucky.

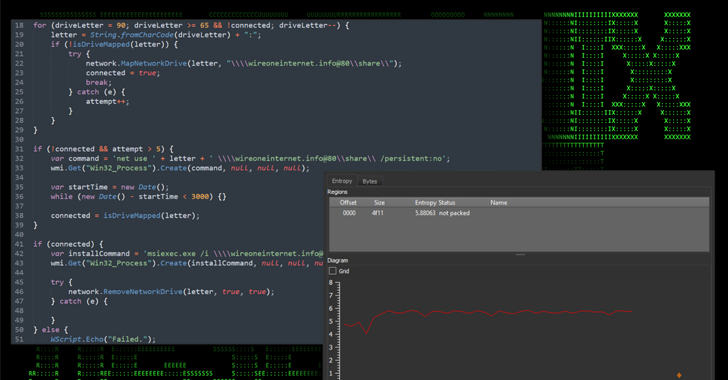

The most common type of tax identity fraud is possible because the IRS does not immediately cross-check a taxpayer’s report of income earned and taxes paid against employer reports of income paid and taxes withheld. Refunds for over-payment of taxes are thus sent out before the W-2 and 1099 data is verified, allowing crooks to submit fake reports of taxes paid above and beyond taxes owed, resulting in a refund due. This type of fraud is further facilitated by the option to file electronically and get your refund delivered on a pre-paid cash card, or directly deposited to an anonymous card (for example, the “Green Dot” Visa or Mastercard you can buy at many drugstores has “routing and account numbers suitable for direct deposit” according to the Wall Street Journal).

Before you accuse the IRS of being completely irresponsible for behaving like this, bear in mind that congress pushed the agency to promote electronic filing, immediate payment of refunds, direct deposit and cash cards. (The point of cash cards was to assist people who don’t have bank accounts and therefore had to use check cashing services to get their refunds, thereby falling prey to check-cashing scams.) And as far as I can tell, Congress routinely messes up the budget of the IRS, underfunding key programs in the one government agency that can show you how much incremental revenue each new hire will generate.

The IRS does have a program in place to combat tax identity fraud:

“IRS Criminal Investigation (CI) detects and investigates tax fraud and other financial fraud, including fraud related to identity theft. Identity theft is most likely to occur in our Questionable Refund Program (QRP) area where individual identities are stolen with the intent to file false returns claiming tax refunds.”

What could go wrong?

1. Your return is rejected: If you find that another a tax return has been filed with your Social Security number, you should use IRS Form 14039 to alert the IRS. Do this right away. You will need to provide information about the tax year affected and a copy of the last return you filed prior to the identity theft. After you have filed this form, keep calling the IRS for updates on a regular basis to prevent your case from slipping through the cracks.

Reading the TIGTA identity fraud report referred to earlier will give you a detailed picture of where cases like this bog down. The IRS has pledged to do a better job with such cases. Try to hold them to that pledge.

2. You are asked to return a refund: This can occur if you are the victim of a different type of scam, as reported in the Wall Street Journal, in which a more skilled criminal uses routing information from a victim’s personal check. The criminal will “trick the electronic tax-payment system into transferring funds from a victim’s bank account as an estimated-tax payment to another stolen name and Social Security number, then file a refund claim transferring the stolen funds to his own account.” (See “ACH debit block” below as a means of defeating this scam.)

3. You are accused of under-reporting income: You could potentially be contacted by the IRS for not reporting income when in fact you did not earn that income. This happens when someone else gives your Social Security Number to an employer; that employee’s earnings are reported to the IRS in your name and the IRS notices you did not include them on your return. If this happens, do not panic, simply explain what happened. Remember, you are not the only person to which this has happened, and the IRS agent will have encountered this problem before. (In my experience, IRS agents are quite reasonable and simply want to get the facts straight.)

4. You are turned down for a loan: You could find yourself turned down for a loan because of discrepancies between your tax record and those that the IRS maintains (because the IRS was tricked into accepting a return that is way different from your real situation).

How to protect yourself

Unfortunately, there is a limit to what consumers and small businesses can do right now to prevent tax identity fraud. One thing we can all do is lobby congress to clean up this mess. In addition, here are a few defensive measures one can take:

1. Protect your Social Security Number: Do not disclose your SSN unless absolutely necessary. For example, avoid using your Social as an account identifier when using medical services (you have the right to demand an account identifier number instead, one exception being Medicare and Medicaid patients). Your Social is the prime ingredient for tax identity fraud and you don’t want to make it easy for the bad guys by being careless with this information.

2. Order your IRS Transcript: This allows you to see what the IRS has on record for you in terms of tax payments and refunds. Contrary to popular myth, the IRS does not play poker with your data, they are quite happy to share with you the data they are holding that relates to you. Just Google “IRS transcript” and you can find how to do this at irs.gov. If you use a reputable accounting service, they should be happy to get your transcript for you (the IRS will verify this request with you).

3. File your returns early: This is not always feasible, but the thinking is that it limits the opportunity for fraud in the current filing period. However, this will not stop estimated tax fraud where a criminal uses your bank account number and bank routing number to make an estimated tax payment to the IRS on behalf of a stolen name and Social Security number, then claims a refund which the IRS pays to an account under the control of the scammer.

4. Monitor your bank accounts: Always a good idea when there are so many people trying to get away with bogus charges these days. Try to review account transactions at least once a week and immediately alert your bank when you see something that you didn’t authorize. Note that some banks have alert services that will email or text you every time money is taken out of your account, a great way to stay on guard against fraud.

5. Ask your bank about an ACH debit block: Putting an ACH debit block on your account prevents crooks taking money with this type of transfer, however, it could prevent you executing legitimate online or over-the-phone electronic payments.

6. Lobby for change: Yes, I mentioned this before, but it is worth repeating. And it is not as hard as you might think, you can even get apps for this. Consider the “Congress” app from the nonpartisan Sunlight Foundation, which is free and comes in iOS and Android versions. It can find your representative and let you place a call to their office with just a few clicks. For more tips on Internet lobbying, read this helpful article by Jam Kotenko on Digital Trends.

If you think you’re a tax identity theft victim

If you find that a tax return has been filed with your Social Security number, contact the IRS right away at the Identity Protection Specialized Unit, toll-free at 1-800-908-4490 so that the IRS can take steps to further secure your account. You will likely need to file you IRS Form 14039 to document your situation to the IRS so start prepping this while you make your call. You will need to provide proof of your identity and the IRS will probably want details of the tax year affected, including a copy of the last return you filed prior to the identity theft.

In some situations, the IRS issues a taxpayer-specific PIN if you have had issues with identity theft. This PIN is then required on any tax return you file. Go to this page on the IRS website to learn more about the process of applying for a tax return PIN from the IRS.

Finally, when it comes to interaction with the IRS, remember:

“The IRS does not initiate taxpayer communications through email. Unsolicited email claiming to be from the IRS, or from an IRS-related component such as EFTPS, should be reported to the IRS at [email protected].”

Note: I am not a certified accountant, although I have worked as a tax auditor. Nothing said here should be taken as financial planning advice, and I can’t promise answers to every tax fraud related question, but I am keen to help reduce tax identity fraud and would appreciate hearing from you if you have experienced this problem.